san francisco county sales tax rate

1000000 or more but less than 5000000. Presidio San Francisco 8625.

Frequently Asked Questions City Of Redwood City

Visit Auction Page The primary purpose of a tax sale public auction is to collect taxes that have not been paid by the property owner for at least five years.

. California CA Sales Tax Rates by City. Businesses must file and pay taxes and fees on a regular basis. The California state sales tax rate is currently.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco.

Payments at the cashier window accepted until 5 pm. Depending on the zipcode the sales tax rate of san francisco may vary. More than 250000 but less than 1000000.

More than 100 but less than or equal to 250000. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The South San Francisco California sales tax is 750 the same as the California state sales tax.

This is the total of state county and city sales tax rates. The County sales tax rate is 025. San Francisco Assessors Office FAQ Sheets Real Estate Transfer Taxes in San Francisco Transfer tax is a transaction fee imposed on the transfer of land or real property from one person or entity to another.

City and County of San Francisco. The transfer tax rate is variable depending on the purchase price OR the fair market value as shown in the chart below. 1000000 or more but less than 5000000.

340 for each 500 or portion thereof. 6 rows The San Francisco County Sales Tax is 025. The minimum combined 2020 sales tax rate for San Francisco California is 85This is the total of state county and city sales tax rates.

Method to calculate San Francisco County sales tax in 2021. 3 rows The current total local sales tax rate in San Francisco County CA is 8625. Tax rate for entire value or consideration is.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last. The San Francisco sales tax rate is 0. You can find more tax rates and allowances for San Francisco County and California in.

The minimum combined sales tax rate for San Francisco California is 85. The 2018 United States Supreme Court decision in South Dakota v. San Francisco City Hall is open to the public.

6 rows The San Francisco County California sales tax is 850 consisting of 600 California state. The Sales and Use tax is rising across California including in San Francisco County. The San Francisco County sales tax rate is.

Monday through Friday in room 140. The South San Francisco Sales Tax is collected by the merchant on all qualifying sales made within South San Francisco. The California sales tax rate is currently 6.

The average sales tax rate in California is 8551. Walk-ins for assistance accepted until 4 pm. The Office of the Treasurer Tax Collector is open from 8 am.

Everyone who owns property must pay tax every year by December 10 and April 10. SAN FRANCISCO COUNTY 8625 SAN JOAQUIN COUNTY 775 City of Lathrop 875 City of Lodi 825 City of Manteca 825 City of Stockton 900 City of Tracy 825 SAN LUIS OBISPO COUNTY 725 City of Arroyo Grande 775 City of Atascadero 875 City of Grover Beach 875 City of Morro Bay 875 City of Paso Robles 875 City of Pismo Beach 775. The next public auction is scheduled for April 22 through April 24 2022View a list of tax Defaulted Property Subject to Auction.

The Sales tax rates may. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax. A county-wide sales tax rate of 025.

In San Francisco the tax rate will rise from 85 to 8625. 250 for each 500 or portion thereof. San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in San Francisco County totaling 1.

If you travel to San Francisco County youll pay a sales tax rate of 85 percent since the county rate is 125 percent which is 75 percent. Presidio of Monterey Monterey 9250.

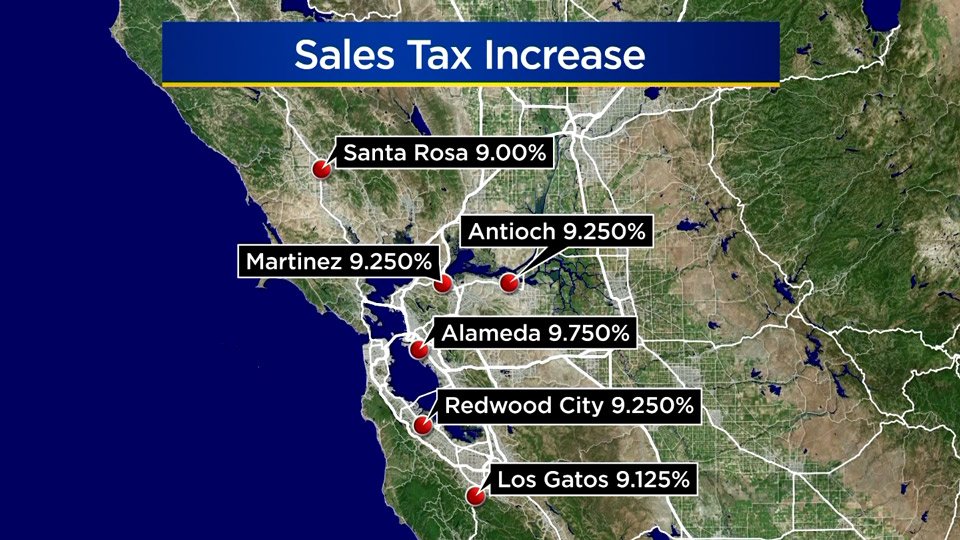

Sales Tax Rates Rise Monday Out Of State Online Sellers Included Cbs San Francisco

States With Highest And Lowest Sales Tax Rates

Worst In The State S F Sales Tax Data Show Likely Population Decline

California Localities Extend Tax Relief To Marijuana Companies In Absence Of State Action

Understanding California S Sales Tax

Understanding California S Sales Tax

How Do State And Local Sales Taxes Work Tax Policy Center

Understanding California S Sales Tax

California Sales Tax Small Business Guide Truic

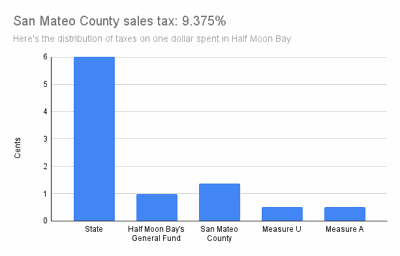

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Understanding Where California S Marijuana Tax Money Goes

Sales Tax Collections City Performance Scorecards

Understanding California S Sales Tax

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Gas Taxes Increasing In The Bay Area And California

Understanding California S Sales Tax